If you owe a debt, how can a creditor collect from you?

The first, and most common way, is to persuade you to pay voluntarily. This is normally done through telephone calls and letters.

If you are unable or unwilling to come up with the amount or the terms the creditor is willing to accept, the creditor’s next step is to get to you to pay involuntarily – that is, through court action.

If the debt is a consumer debt, the creditor must first file a lawsuit, and then get a judgment against you, before taking money or property from you without your consent. A “judgment” is simply an order from a court stating that you owe a certain amount to the creditor, and that the creditor may now exercise whatever legal options that are available to collect the judgment.

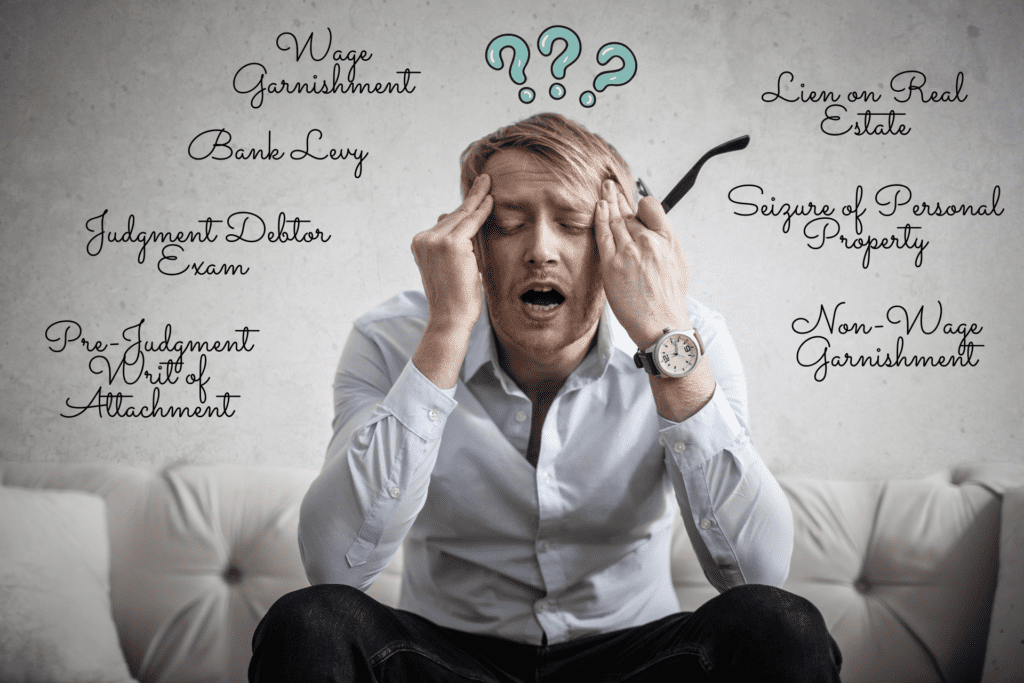

The most common ways that creditors collect judgments are:

WAGE GARNISHMENT. If you are working for someone else as an employee, that is, for wages or a salary, the creditor can get a portion of your wages – normally up to 25% of your take-home pay.

BANK LEVY. If the creditor can find out where your bank account is, the creditor can serve a levy on your bank, requiring the bank to withhold whatever funds you have at the bank.

LIEN ON REAL ESTATE. If you own real estate, the creditor can put a lien on your real estate. The lien will normally be paid off when you sell or re-finance the property. Theoretically, a creditor can force a sale of the property in order to collect the debt, but this is not common in California.

SEIZURE OF PERSONAL PROPERTY. If you have personal property (meaning any type of possession other than real estate), a creditor can have it seized and sold. This could happen, for example, if you owned an expensive car, free-and-clear, or had gold coins in a safe deposit box. This also happens rarely with California consumer debtors. It is more likely to happen with business debtors.

NON-WAGE GARNISHMENT. If someone owes you money, other than wages, the creditor could get an order requiring that person to pay the money to the creditor rather than paying it to you. If, for example, you are a landlord, your creditor could get an order requiring the tenants to pay the rent to the creditor rather than to you. Similarly, if you are working for someone as an independent contractor, rather than an employee, the 25% rule does not apply, and the creditor could get the entire amount owed to you.

JUDGMENT DEBTOR EXAM. This is not really a way to take money from you, but is designed to make life so unpleasant that you will want to pay. The creditor can get an order requiring you to appear in court, and answer, under oath, whatever questions the creditor asks, and produce whatever documents (including bank documents) that the creditor requests.

If the debt you owe is a business related debt, rather than a consumer debt, the creditor can, in some instances, begin seizing your money or property before obtaining a judgment against you, by a:

PRE-JUDGMENT WRIT OF ATTACHMENT. This is a court order freezing whatever assets you have, or at least enough of your assets to cover the amount you are being sued for. To obtain such an order, the creditor must convince the court that there is a likelihood that the creditor will win at trial, and must normally post a bond as well.

There are other methods of collecting debts, but the above are the most common. The foregoing is based on California law and the writer’s experience in California. There are some variations in other states. For example, North Carolina, Pennsylvania, South Carolina and Texas do not allow wage garnishment, except for child support and a few other types of debt. Also, Florida and Texas have unlimited homestead exemptions, so in those states, a lien on real estate (at least residential real estate) is not available to creditor.

The foregoing has been excerpted from Mr. Crowder’s book, Lawsuit SURVIVAL 101, available for purchase here.